Mayor's Public Engagement Unit311

Mayor's Public Engagement Unit311 Search all NYC.gov websites

Search all NYC.gov websites

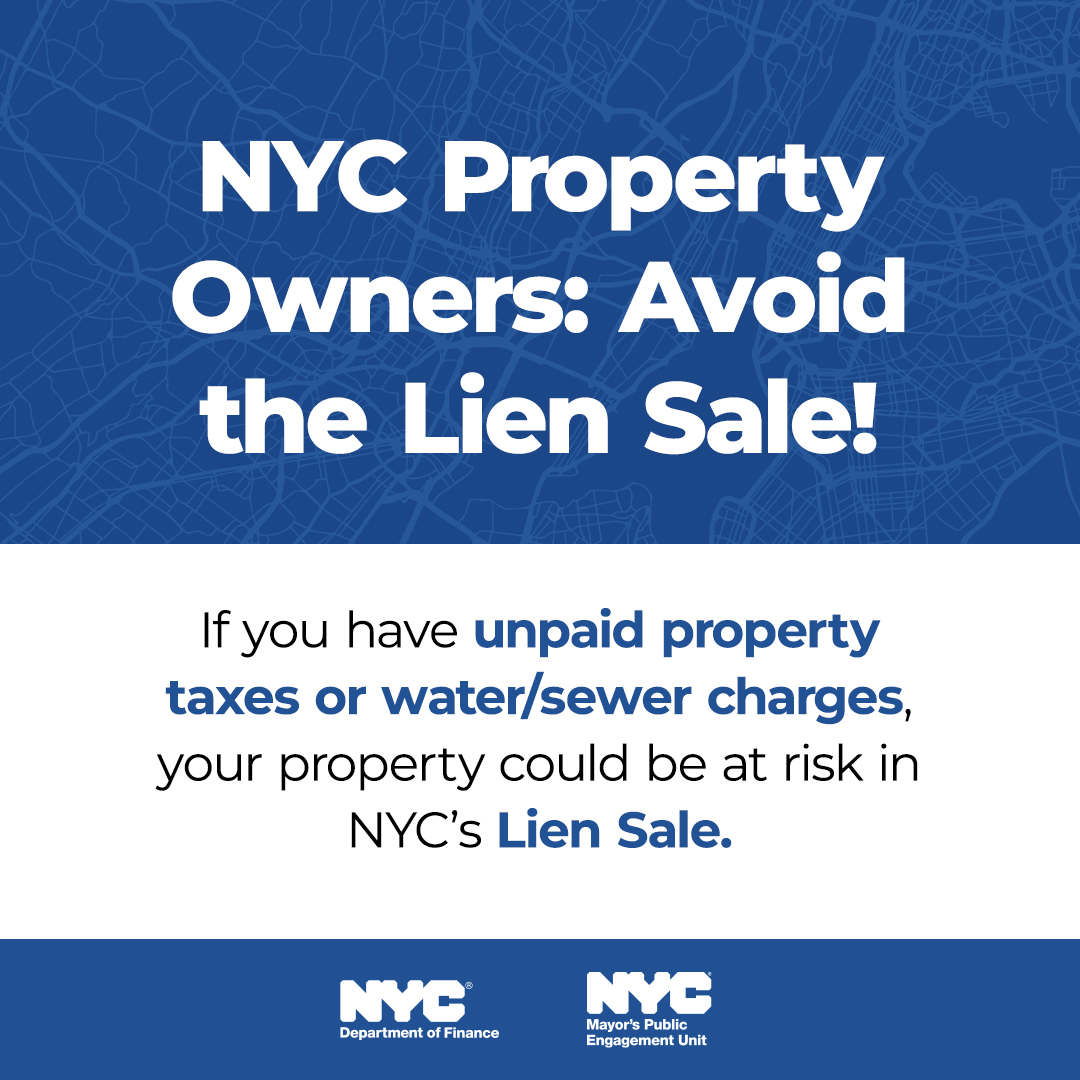

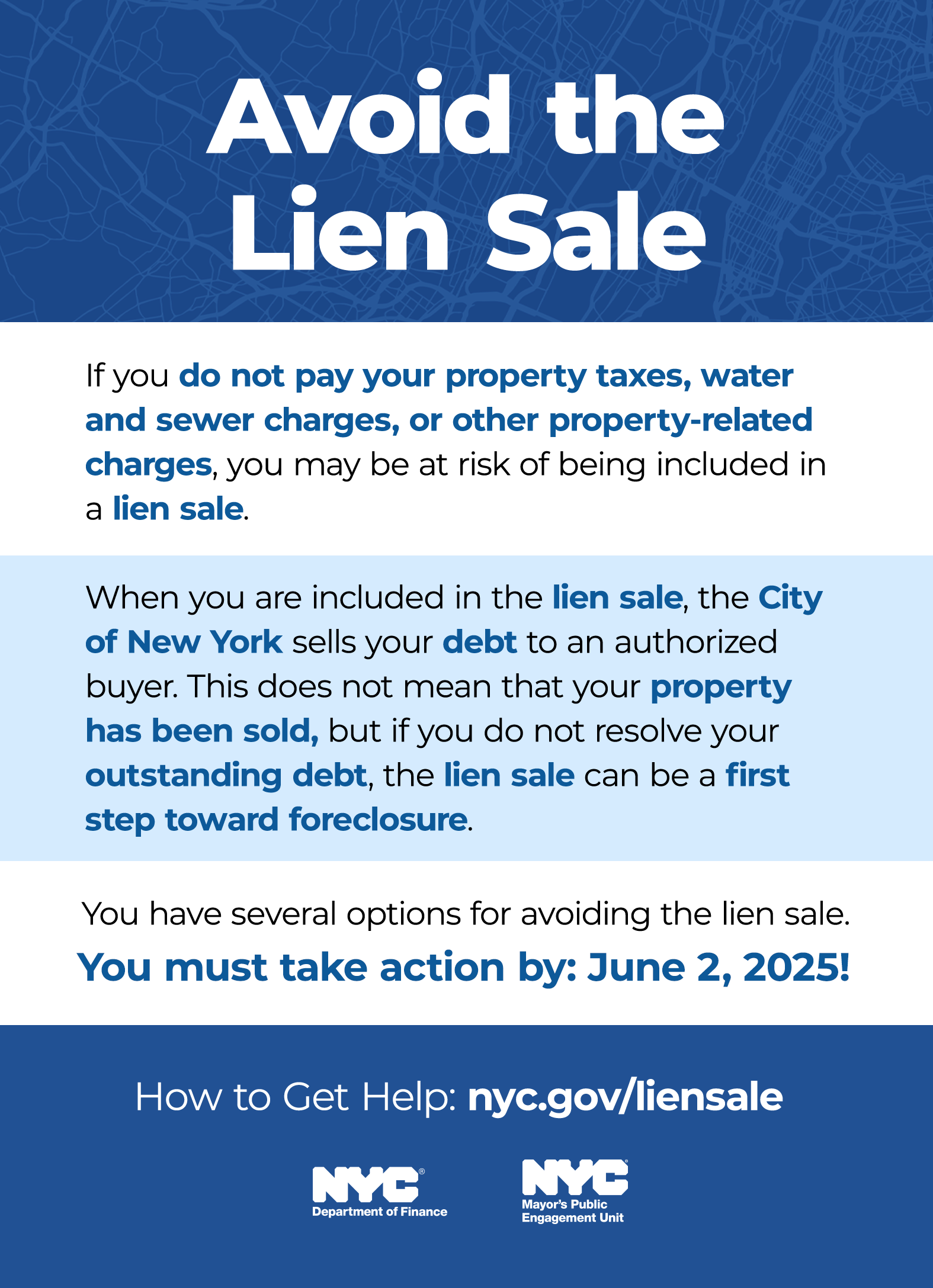

Avoid the Lien Sale

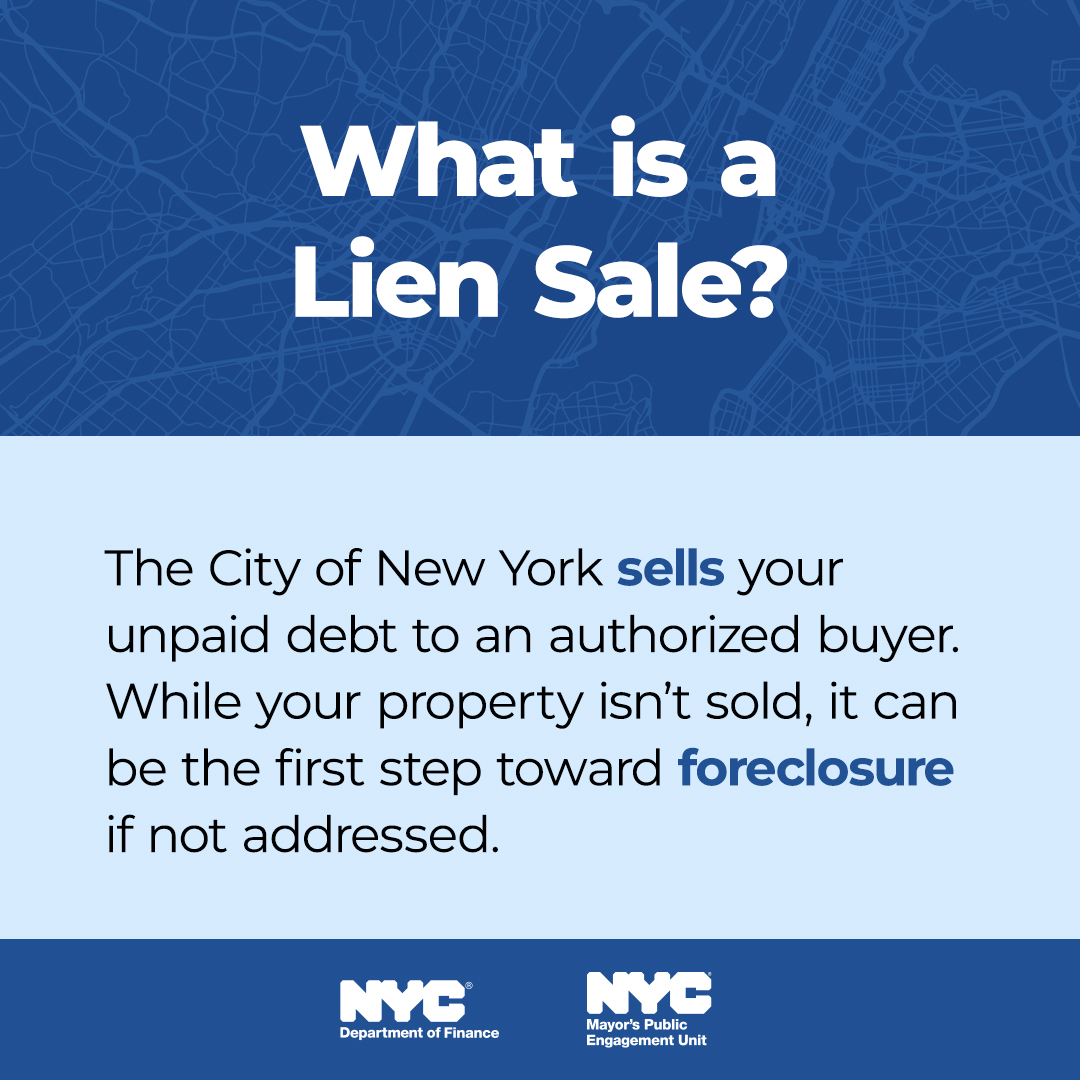

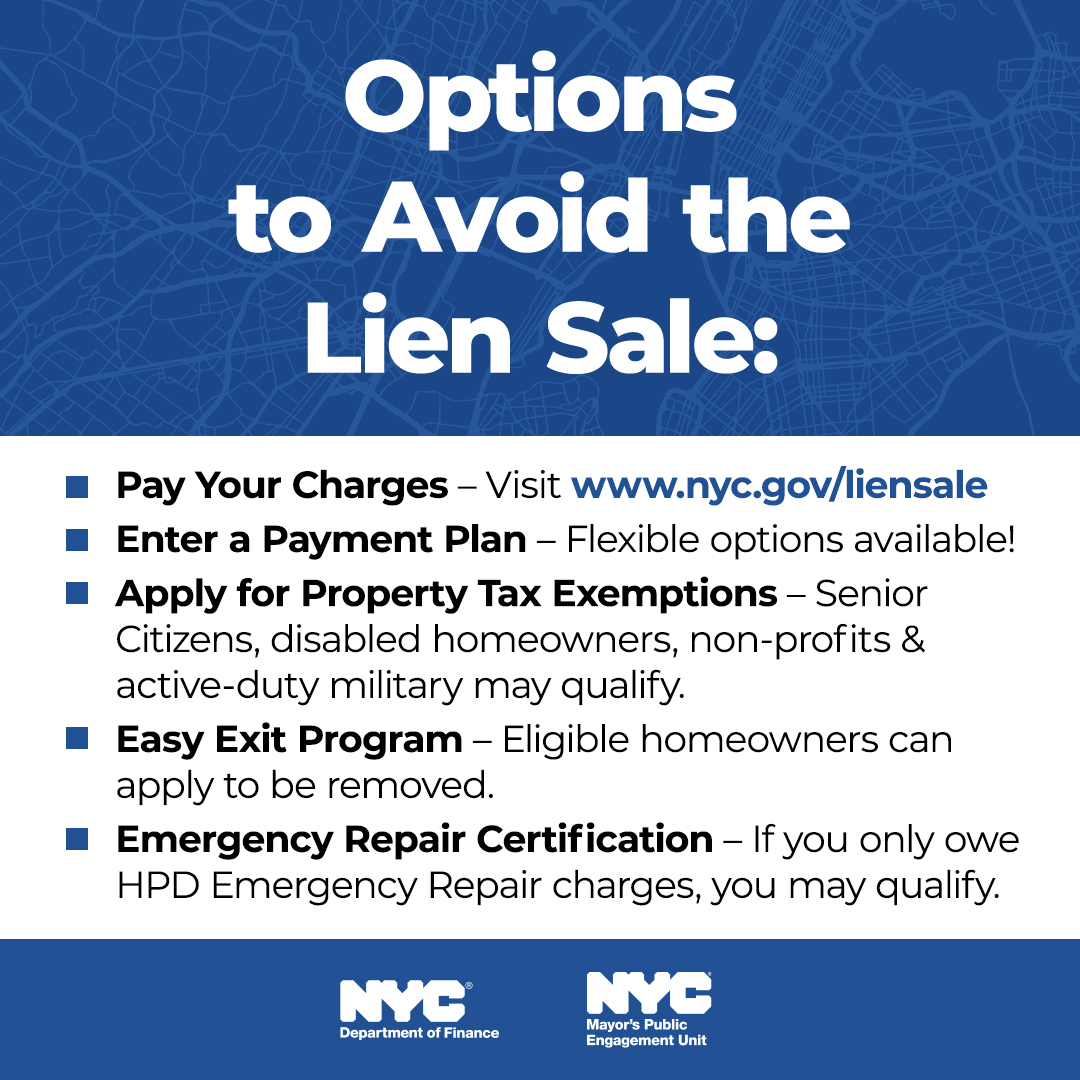

Thousands of NYC homeowners are at risk of losing their homes due to unpaid property taxes, water bills, or other municipal charges. The NYC lien sale process can place homes in jeopardy, but there are ways to prevent it. Homeowners may qualify for property tax exemptions (such as for seniors, people with disabilities, and veterans) or can set up payment plans to avoid their debt being sold in a lien sale. Homeowners must apply for exemptions or payment plans before June 2, 2025. Visit nyc.gov/liensale to learn more.

Help NYC Homeowners Protect Their Homes!

Together, we can ensure that homeowners know their options and take action before it's too late. Help us spread the word about these resources by sharing our graphics and suggested posting text.

Download the toolkit and translations here.

Social Media Toolkit

Suggested Posting Text

- 🚨 NYC homeowners: Protect your home! If you're behind on property taxes or water bills, you may qualify for tax exemptions or payment plans to avoid the lien sale. Take action before June 2! nyc.gov/liensale 🏠 #NYCHomeowners #LienSale

- 🏡 Don't let unpaid property taxes or water bills put your property at risk! NYC homeowners may qualify for tax exemptions or payment plans to avoid a lien sale. Get help now at nyc.gov/liensale or call 311. 🗓️ Don't miss the June 2 deadline! #NYCHomeowners #LienSale

- Got property taxes or water charges due? Make a payment. Set up a plan. Keep your home safe. 🔜 Deadline to avoid a lien sale is June 2. Learn more at nyc.gov/liensale or call 311. #NYCHomeowners #LienSale

Suggested Newsletter Text

How to Avoid a Lien Sale

Thousands of NYC homeowners are at risk of a lien sale due to unpaid property taxes, water and sewer charges, or other property-related fees. Fortunately, there are options available to help protect your home. Eligible homeowners can apply for property tax exemptions or set up payment plans to manage outstanding balances.

To avoid a lien sale, homeowners must take action by June 2. Don't wait, visit nyc.gov/liensale for more information, or call 311 for assistance.